It’s learning from experience.

The federal government and insurers learned from the last year’s inaugural open enrollment period under the Affordable Care Act that it takes more than low premiums to persuade the uninsured to buy federally mandated health coverage, especially in a state like Texas, where leaders oppose the health care law.

These consumers, many of whom have never been insured, want more in-person, one-on-one help from someone who speaks their language to explain how deductibles, out-of-pocket costs, premiums and subsidies can affect a plan’s total value. That assistance also must be convenient because many people don’t have the time or means to travel to find the help they need.

In response, insurers are meeting the uninsured where they typically go for medical care, social services and shopping – health centers, neighborhood multiservice centers and grocery stores. They also have extended call center hours, increased their social media presence and improved websites to make insurance education and enrollment information, in English and Spanish, more accessible. Additionally, pharmacists at CVS Health, H-E-B, Kroger, Walgreens and Wal-Mart are helping customers find enrollment assistance and holding sign-up events.

[…]

“Last year, we learned a lot about the need to provide people the information they need,” said Dr. Bob Morrow, the Southeast Texas chief medical officer for Blue Cross Blue Shield of Texas, one of the state’s largest insurers. “Buying insurance can be confusing. We really learned how important it is to get information to people on their terms.”

The strategy makes perfect business sense, said Partha Krishnamurthy, marketing professor at the University of Houston’s Bauer College of Business. The marketplace’s first year was an experiment for insurers, who wanted to ensure that they could make a profit before investing a lot of money in products and marketing, he said. Obviously, the marketplace proved it could work because this year more insurers are offering plans and increasing their marketing efforts to attract new customers and retain current ones.

“If the first year had not been successful, they would have fled the market,” Krishnamurthy said. “They have a great deal of incentive to attract and retain as many people as they can before the market gets flooded.”

Nationwide, more than 8 million people signed up for 2014 coverage, including nearly 734,000 in Texas. Still, about 6 million Texans, or 25 percent of the state’s population, remain uninsured. The state has the highest rate of un-insured residents nationwide.

Experts estimate more than 1 million in the Houston area are uninsured, even though nearly 200,000 residents enrolled in 2014 coverage.

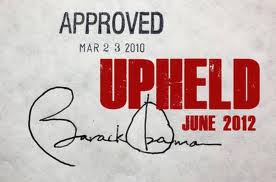

The national enrollment rate has been ahead of projections so far, thanks to a functioning website and a broad array of affordable plans. Funny how you don’t hear much talk about death spirals and insurance companies going under any more, isn’t it? The Supreme Court could still throw a major monkey wrench into things, but there’s no point worrying about that now. What I’m looking for is to see how Texas’ numbers, and Harris County’s numbers, look when all is said and done. If there’s one thing that might get me to accept some of the happy talk about Greg Abbott possibly being open to Medicaid expansion, it would be some words and action from him about the importance of getting everyone who is eligible for federal subsidies through the exchange enrolled in a plan. Needless to say, I’m not going to hold my breath waiting for that to happen.